How To Increase Your Stock Price By Creating An Innovation Premium

Would you like to create a new engine of growth? Tap the button below to book a meeting with Dave Linhardt, Founder & CEO of InsightStudios.

What is innovation anyway?

These days, almost every CEO talks about innovation. What's your strategy? "We are innovators," they say. But what do they really mean? What are they really trying to achieve?

Every CEO's job is to create value for shareholders. If the value of the company increases more than the stock market during the CEO's tenure, then she's done a good job. If the company is publicly traded, then it's all about moving the stock price up. Pretty simple, right?

The problem is, the stock price reflects the value of all future cash flows. To determine how much a stock is worth, equity analysts develop forecasts of how much the company is going to make in the future. They discount these cash flows to determine the equity value of the company.

Herein lies the rub for the CEO. If the CEO and her team execute the forecasted business plan perfectly, and they hit the numbers exactly, the stock price stays right where it is. The stock remains flat. There is no value created. When the team hits the plan, all they did was deliver on the market's expectation. To increase the stock price, the company actually has to do better than expected. This may be disheartening for the CEO and her team, but it’s just the way equity markets work when they value a company.

In general, there are two ways to do better than expected 1) execute the existing business plan better than the forecast and 2) create new engines of growth that are incremental to the analysts' forecast. In both cases, we are talking about growth. More specifically, to increase the stock price, the CEO and her team must deliver more growth than expected. If they do, their stock price goes up, not factoring in short-term market fluctuations and macro economic of course.

So, when a CEO says they are innovative or that they love innovation, what they are really saying is we are going to grow faster than you think we are. Take that market! Boom!

Innovation = Growth

In other words, when CEOs say innovation, they mean growth.

To say the market is wrong about your company's future is a bold claim. If it's just words, then it's simply lip service. Most investors don't trade on lip service. If growth proclamations are more than words, they have to be supported by results. The company has to actually demonstrate they can grow faster than expected in the future in order to increase the stock price.

Problem

The fact is, most companies fail to deliver new growth beyond analysts forecasts. When this happens, their stock price becomes stuck. This is hell for the CEO and her team because the board and investors demand more. Most CEO compensation is linked to their stock price, as is their reputation for creating value for shareholders.

The key question for any CEO becomes...

How can we increase our stock price?

The Innovation Premium

One proven way to increase a company's stock price is to create an innovation premium. Let's explore what an innovation premium is and how it matters to the company's stock price.

"An innovation premium is the portion of the company's market value that cannot be accounted for from cash flows of its current products or businesses in its current markets." This definition comes from a The Innovator's DNA, a book by Clayton Christensen, Jeff Dyer and Hal Gregersen.

The authors used a methodology developed by HOLT, a division of Credit Suisse Boston, to measure the innovation premium of a large sample of public companies. HOLT developed discounted cash flow models for each company, and compared those values to the stock price. If the stock value was higher than the discounted cash flow model, the difference was called the innovation premium.

When an innovation premium exists, it means the market believes the company will develop new sources of growth that have not been realized yet. Investors believe this company will come up with a new business model or models that will add incremental growth to the business, and these new products or markets will deliver high profits.

If the stock value was equal to the discounted cash flows, the company was being valued based only on the forecast of the existing business under the belief the management team will hit the forecasted plan. If the stock was less, then the market was indicating the company's future prospects are worse then the company is performing today or they don't believe management can hit the forecast.

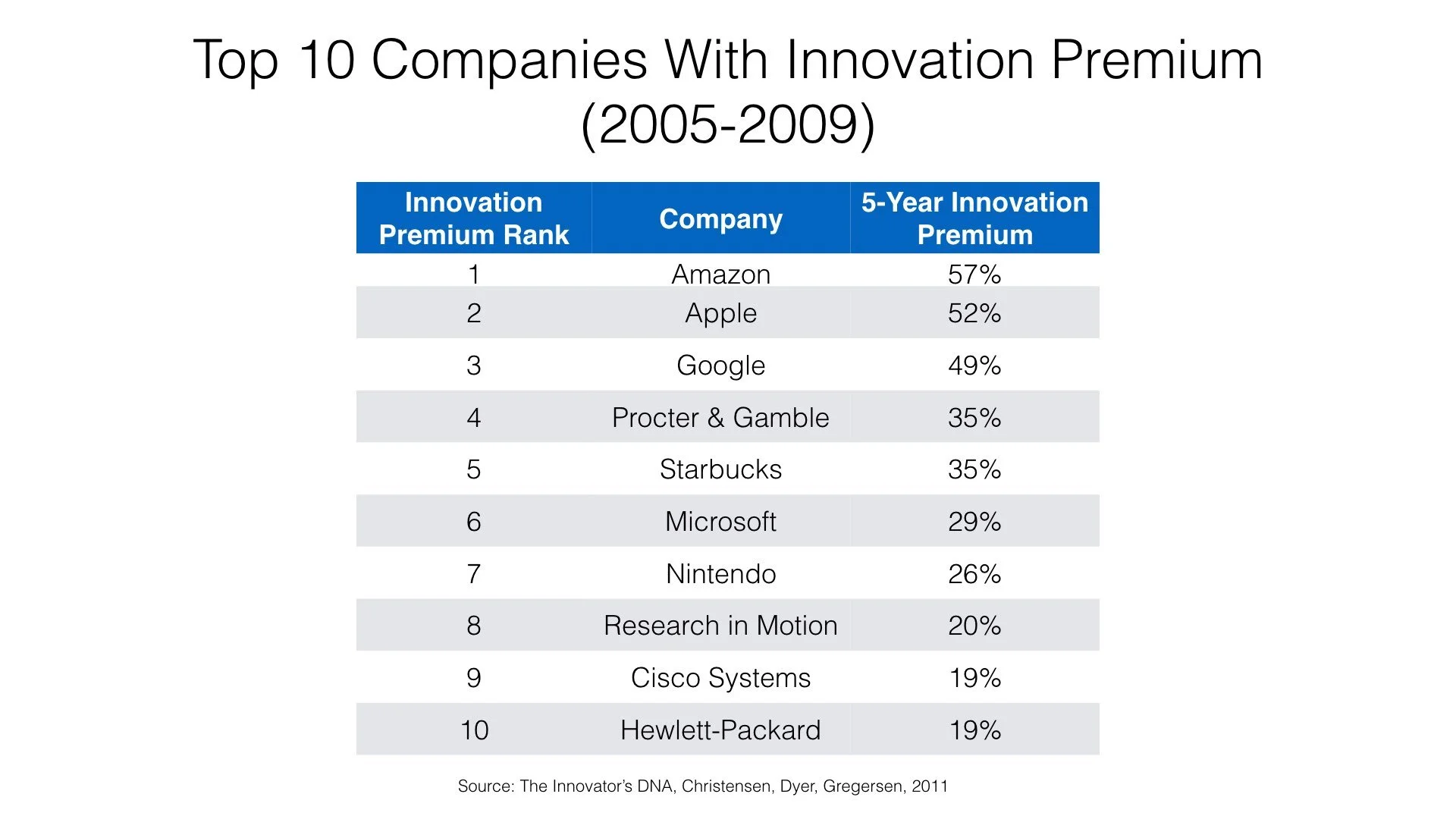

The analysis is a bit dated at this time as it covers 2005-2009. Still, the methodology is still interesting if you consider how these companies where doing at the time. We believe this approach for measuring innovation premium is solid and still applies today. Here are the results of their analysis.

On average, the top 25 companies averaged 35% innovation premium over the past five years. Three companies were over 35%: Google at 49%, Apple at 52% and Amazon at 57%.

The innovation premium for these companies is not trivial. For example, Google's current market cap is $492 billion. A 49% innovation premium means that Google's innovation premium is worth $162 billion. That means the market is betting that Google will come up with new businesses that will deliver high profits worth $162 billion in today's dollars. That's a big bet. The market currently has a lot of confidence Google will develop innovative businesses in the future. They gain this confidence by looking at Google's track record for new innovations, i.e., new sources of growth.

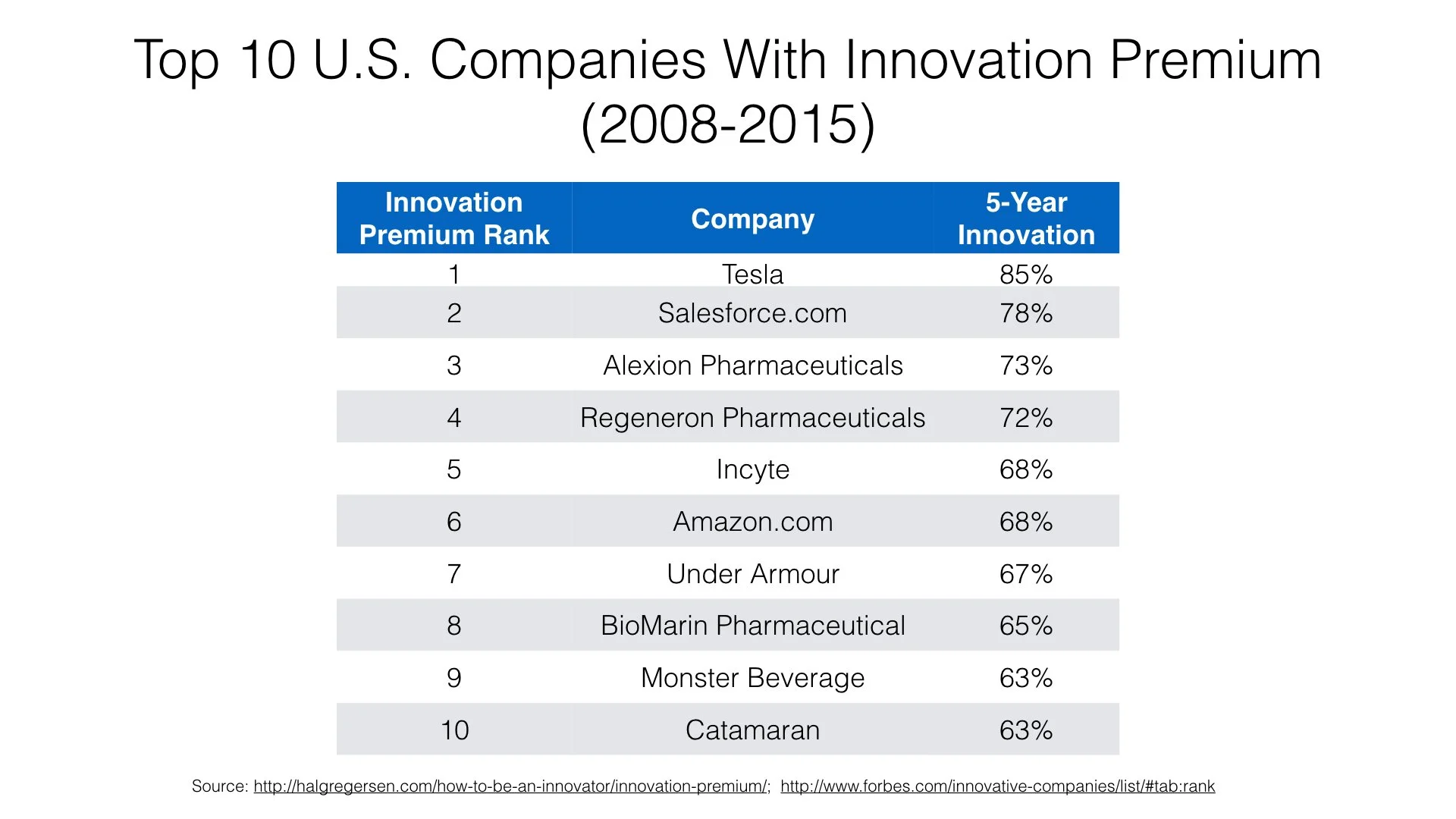

Fortunately, Gregersen and HOLT have continued to calculate innovation premiums for public companies with $1BN in market cap or more. The most recent results are shown below.

Comparing the list from 2009 to the list from 2015, several interesting observations can be made.

Among the top 10 most innovative companies in 2009, only Amazon remains in the top 10 today. This suggests maintaining an innovative premium is not easy to do. Amazon is doing something truly unique when you consider how long they have maintained their innovation premium.

The top two companies, Tesla and Salesforce.com, were not on the list in 2009. This indicates it's not only likely, but perhaps probable, the most innovative companies five years from now are those that won't be on the radar today. In fact, of the top 10 most innovative companies today, nine were not in the top 10 just six years ago. This list seems to be obtainable by upstarts and underdogs.

Apple is also an interesting case, as it always is. In 2009, Apple was #2 on the list of companies with the highest innovation premium at 52%. Today, Apple's innovation premium is 10%, placing it in 282nd place. According to Gregersen and HOLT, et.al., Apple isn't even close to being one of the most innovative companies in the world today as measured by its innovation premium.

Finally, the top innovative companies have raised the bar significantly in the past six years. In 2005, the top innovation premiums ranged from 19% to 57%. Today, the range is higher and tigher, from 63% to 85%. This suggests some of the most elite companies are getting much better and developing new innovations and turning them into real growth in revenues and profits.

Is it worth it for your company to create an innovation premium? Do the math. Take your current stock price, assuming no premium, and multiply by 1.63 or 1.85. This is your target stock price if you can develop the mindset, processes and culture that enables your company to develop new innovations and transform them into meaningful growth. The result is what your stock price would be if your company was as innovative as Amazon or Tesla. For any company, a 63 to 85% increase in their stock price is a really big deal for all stakeholders.

The Answer

By analyzing the companies with an innovation premium compared to the others, a few key insights emerged from the data. In summary, to create an innovation premium, a company needs to do just three things.

Develop Horizon 2 and Horizon 3 capabilities

Deliver a new engine of growth (new product or new market)

Establish the CEO as a known innovator

Let's take these one at a time.

1. Develop Horizon 2 and horizon 3 Capabilities

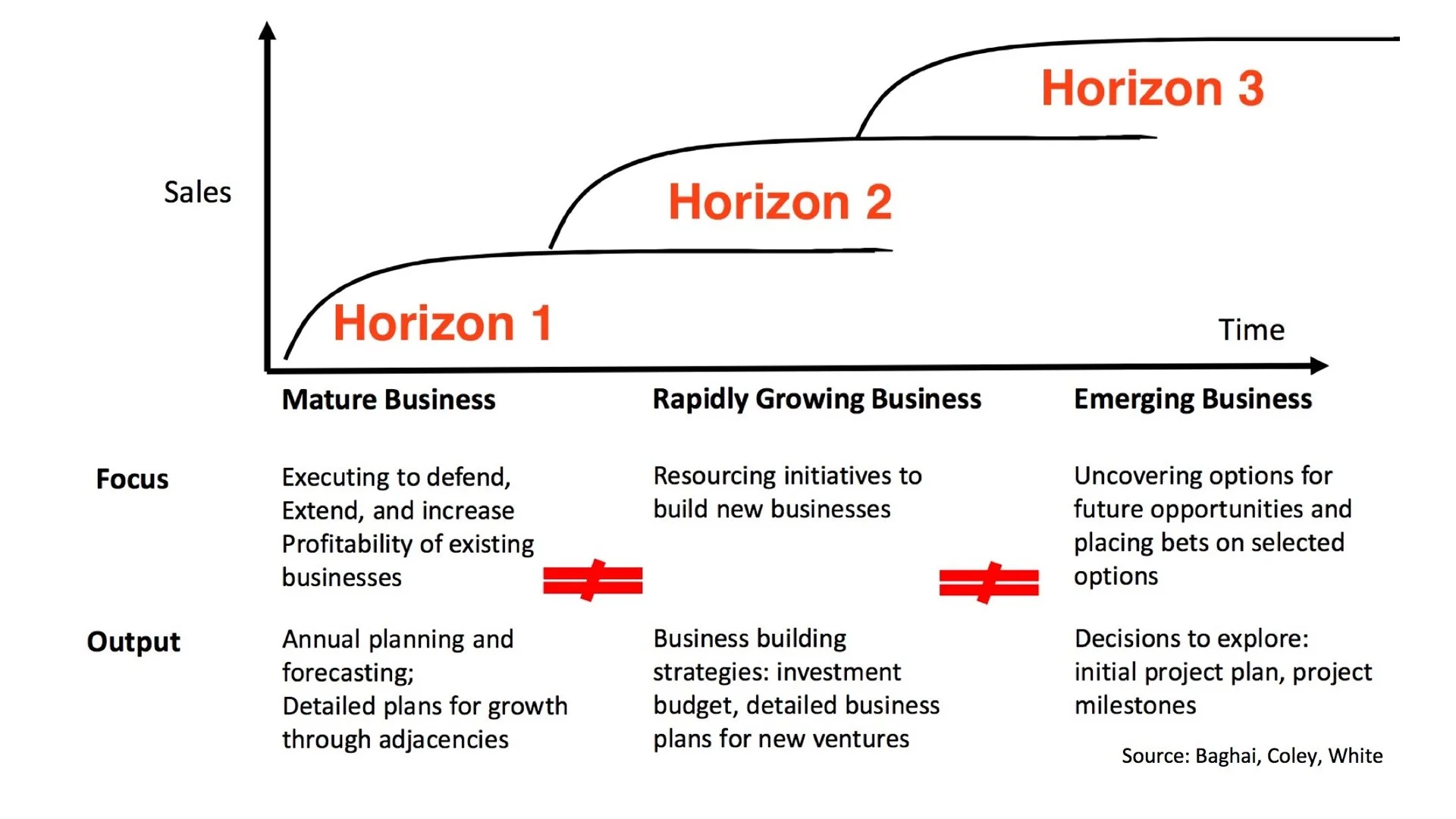

McKinsey & Company developed a useful innovation framework called the Three Horizon's framework. It categorizes innovation projects based on where the business is in its lifecycle.

Among the top 25 companies that had an innovation premium, all of them invested in projects that covered all three horizons. Most companies invest in Horizon 1 projects. These are projects that create sustaining innovations necessary to support the core business. What sets the innovators apart from the pack, is their willingness to invest in Horizon 2 and 3 projects as well. In other words, if you want to be a true innovator in the minds of investors, you must invest in new business models and establish them as new engines of growth for the company.

There is another key point that is often missed in the analysis. In order to create new engines of growth, companies need to step outside of their existing business model and create new business models. Unlike sustaining innovations, disruptive innovations require venturing into uncertainty, experimenting, failing and learning. Companies that are good at Horizon 2 and 3 projects, recognize these projects are fundamentally different from projects that support the core business. Because Horizon 2 and 3 projects are uncertain by definition, project teams in these areas are searching for new business models. In contrast, Horizon 1 projects are ways of executing a known business model. In this way, truly innovative companies must be ambidextrous. They must be able to do both - innovate in their core business and develop new businesses at the same time.

Most companies have Horizon 1 capabilities. Few have Horizon 2 and Horizon 3 capabilities. To achieve an innovation premium, a company must have innovation capabilities across all three Horizons.

2. Deliver new engines of growth (new product and/or new market)

Consider Apple as an example to illustrate this insight.

The iPhone 7 is a Horizon 1 project. It is a sustaining innovation, designed to support the core iPhone business.

The Apple Watch is a Horizon 2 project. It is an innovation in an rapidly growing market that is outside of the core iPhone business model.

The Apple Car is a Horizon 3 project. It is an entirely new product in a new market and is years away from market launch.

Apple is investing aggressively across all three Horizons. In addition, they have a track record of developing new engines of growth. As a result, they received a significant innovation premium in 2005-2009.

More recently, Apple's stock price has fallen based on the relatively slow growth of the Apple Watch, the decline in iPhone sales and the open question as to whether Apple can deliver a new engine of growth without Steve Jobs. As a result, Apple's innovation premium has shrunk. Time will tell if their Horizon 2 and 3 projects will restore their innovation premium or not.

Google, another company with a significant innovation premium, invests using the following formula across the three Horizons - 70/20/10. In other words, 70% of its innovation investment is on Horizon 1 projects, 20% for Horizon 2 and 10% for Horizon 3.

This is a useful benchmark. Any company who isn't investing 25 to 30% of its innovation budget on Horizon 2 and 3, cannot be considered a genuine innovator by the public markets. They simply won't provide the company with an innovation premium if the company isn't putting its money where its mouth is. When investors see underinvestment Horizon 2 and 3, they consider innovation talk as just lip service.

3. Establish the CEO as a known innovator

Another important insight from the public-company analysis is that companies with an innovation premium are always led by innovative CEOs. For investors, it's a simple requirement for them to believe the management team can truly deliver new engines of growth for the company. Without a known innovator at the helm, investors just don't believe the company is innovative and it will not create successful new products with new business models in new markets.

The best way to establish yourself as a know innovator is to deliver innovations that result in rapid growth and high profits. The more examples the CEO has under her belt, the more credible this argument becomes.

In addition, how the CEO talks about her business is a factor, although less important than actually delivering results. Still, communicating a clear and effective message to investors matters as it helps shape their belief that future cash flows are understated in the current stock price and that the stock will rise over time as the new engines of growth materialize.

Of course, transforming yourself and your business into a company that commands an innovation premium will not happen overnight. It takes a consistent, long-term, sustained effort to accomplish this goal.

We believe it is possible to train, educate and coach CEOs to help them transform into proven innovators. We understand most companies cannot create new engines of growth internally. They aren’t set up for it and there are too many cultural and structural barriers to overcome. However, it is possible to create new engines of growth outside of the existing organization and with the sponsor company’s support.

Investors believe it when they see it. So for CEOs who are proven innovators, they simply create new engines of growth repeatedly so the market has no choice but to create an innovation premium for the business.

Summary

For a company to achieve an innovation premium, and increase its stock price as much as 63 to 85%, it only has to do three things.

Develop Horizon 2 and Horizon 3 capabilities

Deliver new engines of growth (new products, new business models in new markets)

Establish the CEO as a known innovator

This is easier said than done. It takes strong leadership, long-term thinking, great people, strong innovation processes and investor support.

If this post resonates with you, it's likely we can help your company achieve an innovator premium. Contact us today to learn more about our Evolve CEO solution and how it can help you transform your company into more exciting, dynamic and innovative business.

Dave Linhardt

Founder & CEO

InsightStudios.co