InsightStudios Update

July 30, 2023

Quotes

-

“The hardest thing about starting a company is the level and frequency of bad stuff that happens to you. […] So much about being a great entrepreneur is just not giving up. […] This is the most important, non-obvious skill of a founder.”

Sam Altman (Video)

-

Did you ever consider packing it in? “Never. I don't ever give up. I'd have to be dead or completely incapacitated."

Elon Musk (60 Minutes Interview)

-

James T. Kirk: I take it the odds are against us and the situation is grim? Picard: You could say that. James T. Kirk: You know if Spock were here, he'd say I was an irrational, illogical human being for going on a mission like that. Sounds like fun!

Star Trek Generations (clip)

Context

I wanted to provide an update on ComeWith and InsightStudios. The following is a summary of where we are, what we’ve learned and where we are going next. Hold on to your hat.

I created InsightStudios to fundamentally transform and re-invent venture capital. I’ve been building startups for over 20 years. I’ve only taken venture capital once. It was from divine Interventures, a kind of startup studio founded in 1999. I read an article that said they raised $300MM and were building a large number of startups in their startup factory in Chicago. I walked in with a pitch deck and without an appointment. Twenty minutes later, my idea was funded with $10MM in seed capital. It was a “creative” deal structure. But I didn’t care because someone wanted to fund my idea!

Things didn’t work out so well for divine or for my startup that was dependent on them. The dot com bubble burst a few months later and so did their startup factory and my startup within it. However, there was a seed of equivalent benefit within this failure - I discovered I love building startups. It was my calling. I also learned to be careful who you take money from.

I invented my first startup studio by mistake in 2004. That was long before anyone was using the studio label for a business that creates multiple startups in parallel. After leading a turnaround effort at Yesmail and helping sell the company to InfoUSA, I left to create an email marketing company on my own. There was more I wanted to do in email using AI and machine learning to predict click and conversion rates at the user level. I founded the company and invested $5k in seed capital. We were profitable in three months. I continued to grow the business from internal cash flows and never took money from any investors. This allowed me to focus 100% of my attention on Customers and product.

Along the way, we lost SmartBargains who was one of our biggest clients at the time. I was scrambling to find a way to quickly replace the revenue. My solution was to build our own e-commerce website called BargainDepot. This turned out to be a good move as the email business and the e-commerce business took off together. I eventually sold both businesses to a company that became DealGenius. So far, so good.

This experience showed me the power of building multiple businesses in parallel. Both companies were helping each other in a supportive, reinforcing Customer-Supplier relationship. I had visibility to all the numbers so I could figure out the best price point for email services that would optimize net income and EBITDA for both businesses. There were a lot of synergies between these two businesses. I discovered having two businesses helping each other improved the odds of startup success. Email marketing was new at the time and both companies benefited from the synergies. While most venture funds return 1.6x on average, the return from my first startup studio was 1650x. This is the power of frugality, getting money from Customers, building a startup stack and doing it with a small denominator. (Return/Invested Capital)

I later learned this is how Amazon has built so many successful businesses from scratch. Amazon has a proven process that is eerily similar to my process. The startup business units help each other. Amazon is a Zaibatsu. It was cool to learn their process when I worked there during my hiatus from building startups in 2019/2020.

After building five profitable startups in a row with no additional capital, I started to realize I might be on to something. I’m not the best entrepreneur in the world, but I don’t know any other entrepreneurs who created five profitable startups from scratch with just $5K. I may not be the best, but I’m certainly not the worst either. Fortune favors the bold.

Venture Capital is a horrible asset class. Everyone who’s looked at it knows venture returns aren’t that great. In fact, venture fund returns are so bad I don’t understand how venture capital still exists. It’s one of the mysteries of the Universe.

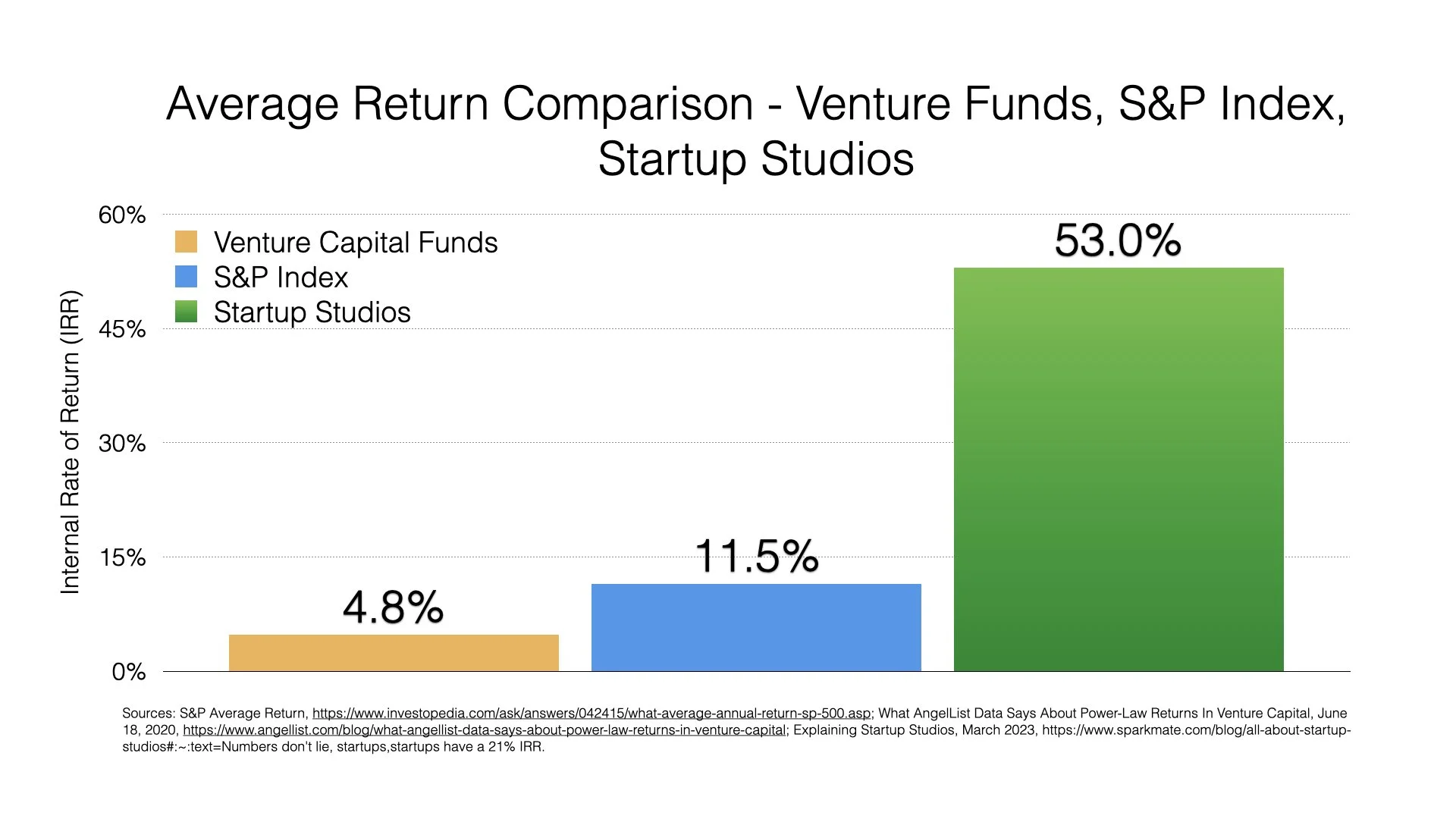

On average, venture funds return 1.6x over 10 to 12 years. Let’s be generous and call it 10 years. That’s an IRR of just 4.8%. The inflation rate in 2022 was 8%. So venture funds can’t even keep up with inflation. Compare this to an average 28-year return to the S&P Index of 11.5%. Are startups higher risk than S&P companies? Of course they are. Most venture funds invest at Series A and many invest at the seed stage. Is it worth it to invest in venture funds? I don’t see why. Why would anyone invest in venture funds if they can make 2.4x more by investing in an S&P Index fund with a lot less risk? Dear Founders, remember this the next time some VC tells you your startup sucks. It seems to me the venture fund business model completely sucks. If VCs are so good at evaluating businesses, then why do they stay in a business model that can’t even keep up with inflation? I’m not bitter. I’m just looking at data.

What happens if everyone stops investing in venture funds? Shouldn’t they? What happens if startup studios generate 7x the return of venture funds? It looks that way so far, at least for the studios that are well run. In my experience, venture fund managers don’t really partner with founders anyway, which is one reason why their returns are so bad. Most fund managers just take their 2% management fees and say no to 99.999% of every entrepreneur they meet. Then they wear their selectivity, negativity and pickiness as a badge of honor saying to their LP’s, “Look at how selective we are!” But no one tracks how many successful startups they passed on. What is the false negative rate for most venture funds? Why don’t they report their false negative rate in their offering memorandums? Isn’t that part of the performance equation? Venture Capital is nothing more than a racket and a Ponzi scheme in my opinion. VCs are quick to criticize everyone else’s business yet they cling to their pathetic business model. Why? It doesn’t make any sense. For God’s sake, try something new! Your model sucks. What do you have to lose? If you are an LP, the best way you can help entrepreneurs is to stop investing in venture funds.

Table 1. Venture Fund Performance Distribution

Table 2. Venture Fund Performance vs S&P Index & Startup Studios

I see an opportunity to fundamentally transform the venture industry. This opportunity still exists today. Imagine a world where venture simply matches the returns of private equity funds. According to Cambridge Associates' U.S. Private Equity Index, PE had an average annual return of 14.65% in the 20 years ended December 31, 2021. If you think about it, venture investing should outperform PE funds because the risk is higher. There is an opportunity to improve the success rate, capital efficiency and returns that startups generate. We can do it by re-inventing how startups are built. While the average venture fund returns 1.6x, my first bootstrapped studio returned 1650x. It’s not theoretical. We’ve done it. If venture can achieve parity returns with PE, how much additional capital would flow into it? 2x? 4x? 10x? This is why I created InsightStudios. This is why I’m willing to take the hits and keep moving forward. I finalized realized we need to do this without venture capital.

The idea behind my second startup studio, InsightStudios, was to raise more capital so we can move faster and take bigger swings. Our long-term goal is to build 150 startups. It’s an aspirational goal. It won’t happen this year. Some advisors have told me to not mention it because I can’t say when it will happen. It took me 15 years to build my first five startups in studio v1.0 with no capital. I want to accelerate this rate so I can get more of my ideas into the market. I have an abundance of good ideas and I don’t want to die with my music still in me. So 150 startups still makes sense to me.

I can manage up to five projects at once as a Managing Director. Each team should produce one spinout startup per year. Over ten years, that’s 50 startups (5 teams * 1 startup per year * 10 years). I can add two additional MD’s that are experienced entrepreneurs like me to get to 150 startups. Easy peasy lemon squeezy.

I set out to raise $10MM, not fully understanding that venture capitalists aren’t going to invest in a startup studio because it doesn’t fit their model. There are exceptions, like my friend and legendary investor Brad Feld. Brad has invested in both PSL and High Alpha. It turns out there is only one Brad Feld, unfortunately. I pitched 705 VCs to discover how rare Brad Feld is. We raised about $500K in cash and in-kind services from friends and family and a handful of gutsy angel investors that I mostly met on Linkedin. We raised an additional $178K for ComeWith. We tried two equity crowdfunding campaigns for ComeWith. It wasn’t enough.

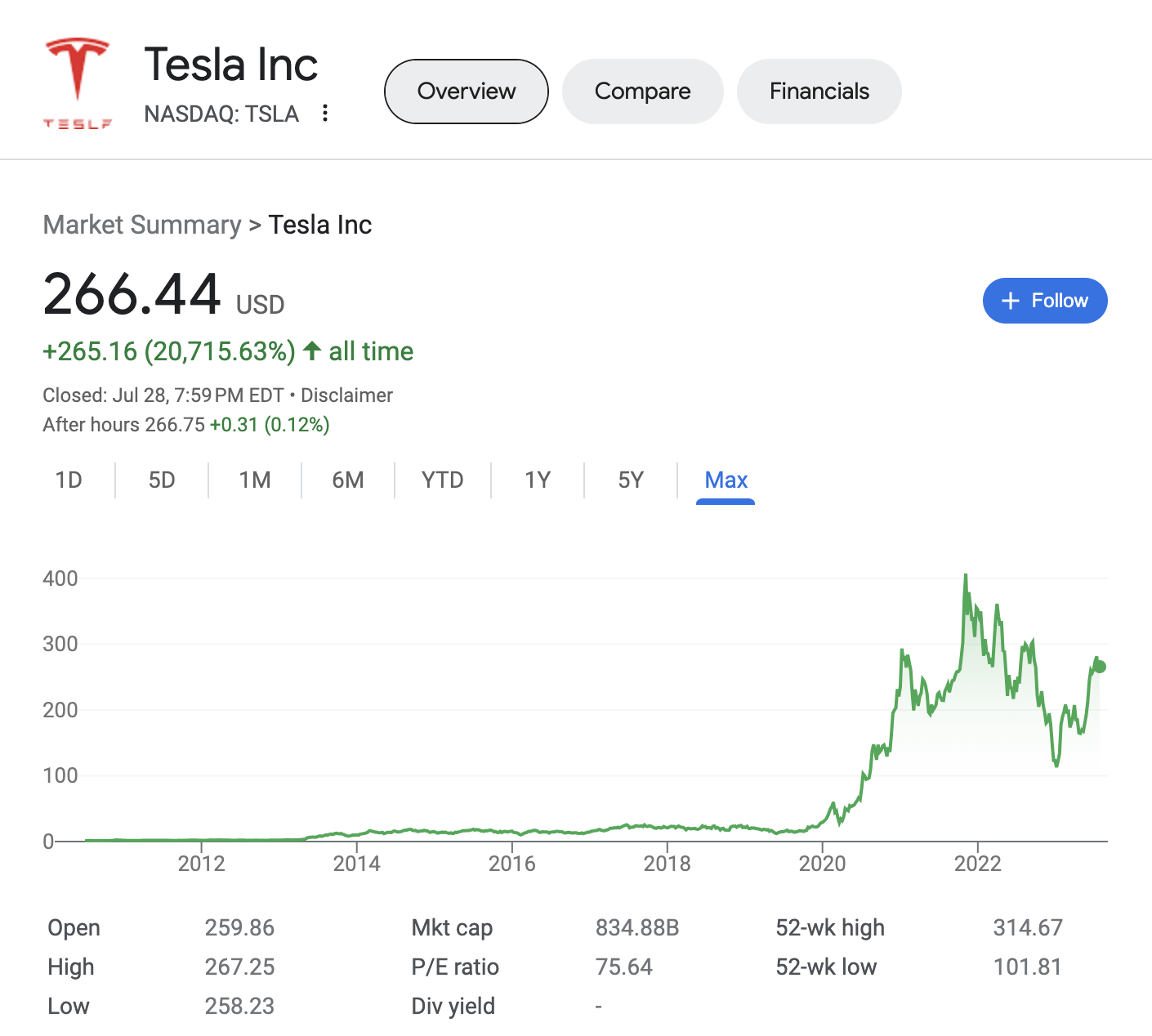

Rome wasn’t built in a day. If you are re-inventing how cities are built, it will take even longer. Startups that set out to re-invent an entire industry take a long time to get traction. Consider Tesla, a startup that is transforming transportation, energy, manufacturing, robotics and artificial intelligence at the same time. When you start a startup, you don’t know what you don’t know. It’s an exploration. This is why we run experiments. We need to see what happens because we are doing something new that we haven’t done before. By definition, the process is highly unpredictable.

For example, when Elon and his team built the first Tesla prototype, they realized the electric motors on the market were insufficient to meet their needs. They didn’t know this until they tried to use one with off-the-shelf parts. The only solution was to design, develop and manufacture their own electric motors. As it turned out, Team Tesla gradually realized over time they needed to invent almost all of the hardware and software that goes into a Tesla electric car today. Tesla even designs and manufactures their own computer chips! This was NOT part of the plan. It’s something Elon and his team realized over time as they got more information by running experiments. This is why it almost always takes longer to build a startup than entrepreneurs initially think. Entrepreneurs aren’t being unrealistic. They just don’t know everything at the beginning. How could anyone know what they don’t know? It’s not possible to know what you don’t know in advance of learning it. You can only move forward and discover it over time as you get into the details of a specific startup opportunity.

This makes me think of bamboo trees. You may not know this but bamboo trees take a while to grow. Before breaking the surface, the bamboo tree builds strong, deep roots in the soil, out of sight. In fact, it takes five years or more of consistent watering and cultivation before the farmer can see the bamboo tree. That requires a lot of persistence and patience without any reward. But once the bamboo tree breaks the surface, it’s one of the fastest growing trees on the planet. With a proper root system slowly developed under the soil, bamboo can grow as fast as 3 feet per day or 1.5 inches per hour. Bamboo grows really fast because it took five years to lay its foundation. Rapid growth would not be possible without a strong foundation.

Tesla was founded in 2003 and went public in July 2010. Looking at the stock chart below, the needle started moving for Tesla in 2020, seventeen years after it was founded. Recently, Tesla has grown like Bamboo. This is because Tesla spent many years building a strong and supportive foundation. Tesla chose to not just build a car, but to make all their own components and re-invent several industries in the process. Soon, we will all have cars that drive themselves. Why didn’t GM think of this?

How many VCs invested in Tesla? How many invested in Space-X?

None. Not a single VC believed in Elon Musk enough to risk their LPs money.

Elon was a successful entrepreneur at the time. He was part of the PayPal unicorn exit. Yet all VCs that Elon knew in Silicon Valley refused to back him. What would their fund returns look like if they had? If venture capitalists aren’t here to identify and support entrepreneurs like Elon Musk, then what the hell are they doing here?

Similar to Tesla, its going to take a while to build InsightStudios into a business that re-invents the venture industry. InsightStudios has faced a number of challenges in the past year. I’ll tell you about some of these challenges in the next section. Given our current situation, it’s reasonable to ask the question - Why are we doing this? Is it worth it?

The reason I keep going is simple. Startups don’t have to be hard. Startups can be easy. The way to make them easy is to learn from our mistakes and try again more intelligently. By making it easier for entrepreneurs to find startup success, we will improve the world around us and expand human consciousness as we come into our own as creators of our reality. Based on everything I’ve seen and what I continue to learn, a startup studio like InsightStudios is the best way to empower founders, create more successful startups, and increase investor returns. As long as this is true, we need to find a way to keep going.

Challenges

I’m not going to blow smoke. InsightStudios and ComeWith ran out of money a while ago. We have no meaningful traction and we haven’t found a repeatable business model we can scale. We identified significant market opportunities but we currently lack the resources to pursue them. We are undercapitalized if we want to move more quickly and take bigger swings. The funding market for startups has deteriorated in 2023 and startup failures have increased dramatically. As I’m writing this update, I have no income and I’m currently living in my mom’s house. I pushed it too far with ComeWith and I hit the wall.

But don’t worry. Everything is going to work out just fine.

Harvard Business School taught me that when you run out of money, you are out of business. Evidently that is not true. InsightStudios still exists and I’m still working on it. I continue to believe in the fundamental hypothesis for the business so I continue to push on and face whatever challenges come. We are figuring it out and we will ultimately be successful. Now is not the time to chicken out. Now is the time to dig deep and keep going.

100% our shortcomings are my fault. It’s important to understand these challenges are temporary. We’ve learned a lot and are getting stronger every day.

The primary challenges we’ve faced over the past year are as follows:

We failed to raise sufficient capital to fund the studio. This is my fault. It was more difficult than I thought to raise money from VC’s. It was more difficult than I thought to raise from angels. I was operating ComeWith full-time and I underestimated the level of effort required to raise money for ComeWith and InsightStudios. We need a full-time fundraiser and I think it needs to be me.

ComeWith required at least another pivot as we identified three separate market opportunities. After months of trying to improve LTV/CAC ratios, we couldn’t get the numbers to work. Customer churn was higher and LTV was lower than expected. ComeWith Adventure Club didn’t appear to be viable and we needed to make changes. The good news is we identified three market opportunities that are worth pursuing. These opportunities are BIGGER than the initial opportunity in friend discovery. We need more resources so we can pursue them and turn them into successful startups.

There is an opportunity to re-invent the hospitality operating system from terminal based to mobile based. We built a prototype feature on the ComeWith app and it worked flawlessly in real-world market tests. Bar & restaurant managers want to use it for their entire operation. It looks like our solution could replace terminal-based point-of-sale (POS) systems like Toast, a $10BN company.

There is an opportunity to create OpenTable for events by creating an Experience Creator and Venue marketplace with integrated payments. OpenTable doesn’t support parties of six or more. We have a prototype marketplace for large party bookings and check splitting. I have confirmation that OpenTable is trying to get into payments and Toast is trying to get into reservations. Both are ideal acquirers for this business if we can get traction with bars, restaurants and event creators.

There is an opportunity to take our web application and develop a new kind of community management application in a SaaS platform for Creators. We’ve analyzed existing providers and no one has yet built a software application that allows online and offline event creators to manage their business effectively. We could develop the ComeWith platform into something that competes effectively with Meetup and Mighty Networks.

I’ve been distracted trying to find a source of income. Sometimes it’s difficult to stay focused on building startups when you’re out of income. I’m working through it and things are getting better as our services pipeline has grown over the past two months. I’m turning my attention to our next funding round as well. One way or another, we are going to get this done.

Challenges aside, there are successful startup studios operating today and more are coming. As I’ve talked to other studio managers, there are two primary questions that every startup studio needs to answer.

Key Question(s):

How are we going to fund the studio?

Where are the founders going to come from?

The Plan

Objective 1: Build services revenue

With the venture funds passing on startup studios, we need an alternative source of capital and revenue. This will be better in the long run as we will retain more equity for the founders and our investors (that’s you!).

If we build recurring revenue businesses, we can fund the expansion phase of our startups with debt financing from companies like Pipe. Each startup costs $250K to go from 0 to 1. Once we have found product-market fit and LTV/CAC >=3, we can use recurring debt to scale all the way to the exit. This would allow us to retain 100% of the equity among the founders and studio investors. It doesn’t depend on venture capital in any way, shape or form. I like this model a lot. Now we have a funding strategy to go from 0 to 1 and then to exit while retaining all of the equity. Disco!

With conservative assumptions, we can exit for $50MM on average in five years or less. 50% of our spinouts will create an exit. In this scenario, each studio will generate an average return equal to $250K * 50% * $50MM * 100% = $6.25MM. Over $250K invested, that comes to a return multiple of 25x. That’s 16x higher than the average venture fund (25x/1.6x) or 90.4% IRR. It’s worth it. In addition, our operating agreement allows us to recycle 20% of the gain to build more startups. Each average exit will allow us to create five additional startups (# new startup funding = ($6.25MM - $250K) * 20%) / $250K per startup = 5 new funded startups per exit). Once we achieve this, we won’t have to worry about money any more as InsightStudios will become a self-funded perpetual money machine.

The entire game we are playing at this stage is about getting to our first exit. That’s the first big milestone. Once we achieve this, it changes everything. Therefore, this is our singular focus from this point forward.

To fill any funding gaps and to provide operating cash flow, we are focusing on services. We’ve identified several sources of services revenue. We are building our pipelines and working to close our first engagements right now.

Corporate innovation consulting for established companies with 200 employees or more. Established companies with visionary CEOs realize they need to increase growth. When growth stalls out in their core business, CEOs start looking around for new ideas. This exploration drives their need to create a new engine of growth, which I define as a new product or service that has a different business model than the core business. In this use case, companies often struggle because their entire organization is designed and incentivized to execute their current business model, not invent a new one. This is where we come in. Our proven methodology together with experienced entrepreneurs allows us to build new engines of growth for companies on an outsourced basis. I’ve done this before and it’s a viable market opportunity with the right sponsor CEO. In addition, some of the consulting projects will lead to startup building investments where the sponsor company invests in a newco that we build for them. Several companies have gotten traction with this model, including High Alpha Innovation. I learned from their CEO that High Alpha closed 22 sponsored startup investments in 2022 at $2MM each. This traction provides validation the corporate startup building market is finally here. More and more established businesses are realizing they can’t create new business models and would be better off outsourcing these projects to experienced entrepreneurs. We will position InsightStudios as a startup studio for hire and find corporate innovation opportunities that line up (SSaaS: Startup-Studio-As-A-Service). Our current pipeline includes the following companies: StackOverflow, Newo.ai, Active Prospect, InMarket, Proximity Marketing, Amplifi Labs, Artemis Connection, True Terpenes and MxM News. I expect to close our first corporate innovation contract soon.

Startup Samurai for funded startups that are stuck. 90% of startups get stuck during the development process. Failures occur when founders are struggling to find product-market fit or scalable, repeatable business models they can scale. We can leverage our experience and methodology to help these companies get over the hump. Unlike the corporate market, startups won’t be able to pay $50K per month for one of our experienced founders, but they are able to pay for fractional time starting at $5K per month. The sales cycle on these deals is short. We can string a handful of these deals together to generate services income to pay some bills and to develop relationships with founders and investors.

FounderDojo Basic Training Online Course. I created a startup school in partnership with Techstars 10 years ago. The school was called FounderSensei and it was totally free. I did it as a give back to the startup community. To my surprise, FounderSensei was rated the #1 lean startup training program in the world by UP Global. I’ve rebranded and relaunched an online course called FounderDojo Basic Training based on the course I created at FounderSensei. The online course is 100% self-serve. We charge for the course and all the course content. We also provide live support in group zoom calls where entrepreneurs can ask questions and get help applying the principles to their specific startup situation. After the free period, live online support costs $99/month. Although I have FounderDojo in the services category, it’s really a SaaS business and one of the startups in our pipeline. We are building a software application around our method and we will sell it under a SaaS subscription. Importantly, the relationships we develop with founders will create a network of talented entrepreneurs that can build startups at our studio down the road. We sold our first course the other day and are working on generating more referrals from angels and inbound leads from organic, content-driven channels on Linkedin and YouTube.

As we gain more traction with services, our solutions will provide revenue and cash flow for InsightStudios and strengthen our ability to create more startups.

Objective 2: Build more relationships with angel investors and successful entrepreneurs

There are 20 investors in InsightStudios. All are friends or angel investors. We’ve shown angel investors will invest in InsightStudios because of the lower-cost diversification our studio provides. Let’s say we are successful in building 150 startups or even our next five startups. Here’s what it costs angel investors compared to the status quo of investing in startups at $25K each.

Cost Comparison: InsightStudios versus the status quo:

Status quo: 5 startups @$25K = $125K

Status quo: 150 startups @$25K = $3.75MM

InsightStudios: 5 startups @$25K minimum investment in studio = $25K ($5K per startup)

InsightStudios: 150 startups @100K minimum investment in studio = $100K ($667 per startup)

In my view, an investment in InsightStudios is a no brainer. I’ve priced it to be this way by design.

In addition to providing lower-cost diversification, an InsightStudios investment gives investors multiple shots on goal. Consider ComeWith. It turns out we need more funding to execute a pivot for ComeWith. If we are unable to get it done, then the ComeWith project fails. If an investor would have invested in ComeWith, she would have lost her money. If she invested in InsightStudios as a way to invest in ComeWith and our other startups, then she still has equity in the studio and all the future startups we create. When you invest in our studio, you are essentially getting an equity interest in every startup I create or help create until I die, retire or become incapacitated. An InsightStudios investment isn’t exactly indentured servitude, but it’s close. I’m planning to live to 150 so there may be a long tail on a studio investment made today. As we expand the team of entrepreneurs, we just get stronger and more diversified.

We will continue to raise money for InsightStudios with an exclusive focus on angel investors, angel groups and angel syndicates. That’s the market where we’ve found product-market fit. There are a lot more angel investors out there than we’ve met so far.

Objective 3: Focus on B2B SaaS projects that are generally easier to bootstrap

In my first studio, Maverick Direct Marketing, we created five startups:

e360Insight, an email marketing platform (B2B SaaS); exit

BargainDepot, an e-commerce company like Amazon (B2C); exit

e360data, a consumer data company (B2B DaaS); exit

Life Phase Media, a consulting company (Professional Services)

LegitLead, a lead scoring platform in the education market (B2B SaaS); killed by divorce

e360Insight was our first startup. We got to profitability in three months. I was able to live off the income in six months. From there, we grew organically and used the operating income to fund the other startup ideas. The entire studio came into existence from our first profitable startup, that happened to be a B2B SaaS business.

In my experience, it’s easier to bootstrap a B2B SaaS business than a B2C software or marketplace startup. With B2B, you can get your first Customers through direct sales, networking and hustle. It takes time but it doesn’t cost money out of pocket if you are willing to hustle as the founder. With a B2C startup, it costs more in product development to build a product that is acceptable to consumers, and it costs more in marketing and Customer acquisition. For a B2C business to work with limited capital, you need a competitive advantage in Customer acquisition and a direct-to-consumer revenue model. With ComeWith, we developed a scalable Customer acquisition model with Meetup but we couldn’t get enough consumers to pay and maintain their subscription service for Adventure Club. So unless we have rock solid plan for B2C that gets to revenue and profitability quickly, we will focus on B2B SaaS businesses and take shots with novel software applications that we can bootstrap. I expect at least 90% of our projects will be B2B SaaS startups with recurring revenue models. The only exceptions will be B2C businesses if we can meet the two conditions above.

Objective 4: Leverage equity-based resources to develop proof points before funding

When we raised enough for our first startup, I switched into entrepreneur mode and ran the ComeWith project as Founder & CEO. The idea was to make ComeWith successful and then all the capital we needed would automatically flow to the studio. It hasn’t worked out that way, yet.

The decision to build one startup was made out of necessity but it wasn’t really implementing the studio model. InsightStudios builds startups in parallel, not in series. In order to implement our studio model, we need to hire entrepreneurs to lead our projects and attract the capital we need to fund them. To be successful, I need to move out of a founder role for our startups and into a Managing Director role for the studio. I don’t think I was ready to do this a few years ago but now I am. This change will allow more talented founders to come into the studio and I can focus my energy on recruiting founders, fundraising and helping make pivot, proceed and kill decisions with our projects. This structure will give us a better opportunity to make the studio successful as a whole.

Although it would be great to have more capital in the studio before we hire entrepreneurs, I believe it is possible to bring in talented founders for equity, under the expectation we run our validation process, build low fidelity prototypes and attract investors to back the projects based on Customer proof points. We will attract great founders by providing higher equity stakes than most other studios. Adding angel investor gates to the process will help ensure the startups we are building are in desirable areas that will draw in more resources.

I’m focusing on the current pipeline of six ideas and recruiting entrepreneurs to lead these projects.

ComeWith, pivot to community-building software (B2B SaaS)

Parti, like OpenTable for events with on-demand ordering and payments (B2B SaaS)

FounderDojo, education and knowledge management software that helps innovators improve their odds of success (B2B SaaS)

Customer Value AI, a ML/AI platform that accurately predicts Customer lifetime value at the individual level (B2B Saas)

RentDeets, custom rental credit score derived from 100% of rental payments that are outside of the generic credit bureau system (B2B SaaS)

Freethought, subscription based content and community monetization platform (B2B SaaS)

As we bring in more entrepreneurs and get traction with Customers, the capital for these projects will come. Investors can invest in the startups directly or through InsightStudios for lower-cost diversification. Both options are available depending on the investor’s preferences. You can play it by picking startups or you can play it by taking an index approach. The smart money takes an index approach and invests in InsightStudios. Here’s why.

Objective 5: Partner with funded studios to co-develop startups by leveraging our talent and their capital

Funding has slowed across the startup ecosystem but there are 30 or so startup studios that have sufficient capital to build more startups. I’ve been networking within the community to find funded projects that need a startup CEO or need help making their existing investments work. Where we can help, we can find, recruit and provide a Startup CEO or interim entrepreneurs in exchange for fees and equity in the business. This allows us to generate income by billing out one of our team members and expand our portfolio of successful startups.

Conclusion

While the past six months have been challenging, the InsightStudios story is far from over. In fact, we are just getting started. It’s still day one at InsightStudios.

There are always hiccups, speed bumps and setbacks when building startups. This is normal and it should be expected. It’s been this way for every startup I’ve ever created. The key to success is to receive every outcome as positive, knowing it is here to serve you. It’s an opportunity to learn, gain insight and get closer to the target or move to an even better target.

When I first started my entrepreneurial journey, I was afraid of failure. Now I know that failure doesn’t exist. It’s a phantom and nothing to be afraid of. When you try something new, you either get what you want or you don’t. If you get what you want, then great! If you don’t, then you receive something just as valuable - learning and insight that allows you to make adjustments, pivot and grow. The lessons learned are exactly what you need to build the business of your dreams. So, when you think of it this way, there is no such thing as failure. It doesn’t exist. I no longer fear failure because I don’t believe in failure.

InsightStudios will continue to expand and grow. I have no doubt we will create all the startups we ever wanted to create. We are becoming better at this every day. Eventually, outsiders will see it too as our vision starts to line up with our reality.

How can you help? The ways are infinite. You can refer Customers and investors. You can refer experienced entrepreneurs that are looking for their next projects. You can refer founders that are struggling with their startups and direct them to me or FounderDojo.com for help. You can refer PE firm managers that want to do more with startups and are tired of broken venture fund returns. You can refer anyone who thinks the venture fund model sucks and they want a better way to support technology startups and generate better returns. You can be an advisor and meet with me monthly and get some shares in the studio for your time and effort. You can intro me to angel groups, angel syndicates and/or invest yourself. You can intro me to visionary CEOs that want to increase their growth rate by creating new engines of growth. You can do something else that I’m not thinking of right now. Get creative. Follow your highest excitement. I appreciate all the support and I always welcome it from people who want to see us be successful!

We are raising $2MM for InsightStudios to fund our next six startups. Investors can invest in our next five startups for a $25K minimum or they can invest in our next 150 startups for a $100K minimum. Let me know if you’d like to learn more and review the proposed terms. We do priced rounds so everyone knows what they get at closing.

Please feel free to send any referrals or questions to me at dave@insightstudios.co. Thank you for your help and support! I really appreciate it.

“There is not a single successful company that became successful doing the thing they started with - and that includes Airbnb, Uber and yes, Netflix.” - Marc Randolph, Co-Founder & first CEO of Netflix.

Run when you can;

Walk when you have to,

Crawl if you must;

Just never give up.

Sincerely,

David Linhardt

Founder & Managing Director

InsightStudios, LLC